BTZO trading fees are small charges you pay while purchasing or selling crypto on BTZO. There are two main types: maker fees, when one adds orders to the market, and taker fees, when one takes orders from the market. The BTZO fee structure is quite fair and transparent, charging minimal fees for active traders. Knowing about such fees aids in smart trading and retaining more of your profit.

What Are Trading Fees in Crypto?

Trading fees are like small commissions for using the exchange.

- Why they exist: They help run the exchange and keep it secure

- When you pay: Every time you buy or sell cryptocurrency

- How much: A percentage of your trade value

- Automatic: Fees are taken automatically when your trade completes

Maker vs Taker Fees Made Simple

Maker Fees (Usually Lower)

- You add your order to the market

- Your order waits for someone to match it

- You help create market activity

Example: Placing a limit order away from current price

Taker Fees (Usually Higher)

- You take existing orders from the market

- Your trade happens immediately

- You use existing market activity

Example: Placing a market order at current price

BTZO Fee Structure Breakdown

BTZO has clear, straightforward fees for different types of trading.

Spot Trading Fees

- Maker Fee: 0.10%

- Taker Fee: 0.10%

Futures Trading Fees

- Maker Fee: 0.02%

- Taker Fee: 0.05%

What this means for you:

- Futures trading has lower fees than spot trading

- Making orders is cheaper than taking orders

- No hidden costs or surprise charges

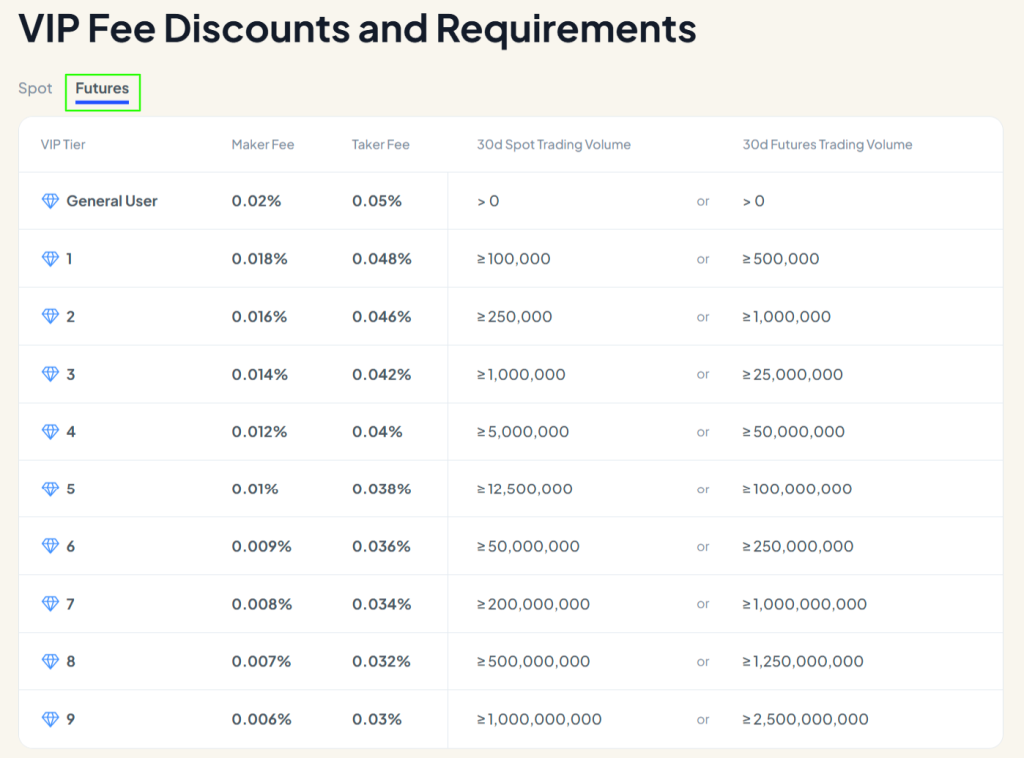

BTZO VIP Program & Fee Discounts

Trade more, pay less! BTZO rewards active traders with lower fees.

How VIP Program Works

- Automatic: Your level updates based on your 30-day trading volume

- Separate Tracks: Spot and futures trading at different levels

- Higher Prices: Lower fees result from higher volume.

VIP Level Examples:

- Starter: 0.10% maker / 0.10% taker (spot)

- Active Trader: 0.09% maker / 0.10% taker (spot)

- High Volume: 0.05% maker / 0.06% taker (spot)

Why Choose BTZO?

- Great for beginners: Same rates as big exchanges

- Best for futures: Low maker fees

- Fair for everyone: Clear VIP program with real benefits

Tips to Minimize BTZO Trading Fees

Save money on fees with these simple tricks:

1. Use Limit Orders

- Set your price away from current market

- Pay lower maker fees

- Be patient for better prices

2. Trade More, Pay Less

- Higher volume = automatic discounts

- Check your VIP progress regularly

- Plan your trading to reach next level

3. Try Futures Trading

- Lower fees than spot trading

- Great for active traders

- Perfect for frequent trading

4. Combine Small Trades

- Fewer large trades beat many small ones

- Reach VIP levels faster

- Save on overall fees

5. Watch Your Volume

- Track your 30-day trading amount

- Know when you’re close to next VIP level

- Plan big trades to reach discounts

6. Use Post-Only Orders

- Guarantee maker fees

- Always add to market

- Maximum fee savings

Winding Up

Understanding BTZO trading fees puts you in control of your trading costs:

- Two fee types: Maker (add to market) and Taker (take from market)

- Competitive rates: Same as major exchanges, better for futures

- VIP benefits: Trade more, pay less automatically

- Easy savings: Simple strategies to reduce your costs

BTZO’s fee system is designed to be fair for everyone. Beginners get standard rates while active traders earn discounts. By choosing the right order types and watching your volume, you can significantly reduce your trading costs.

Ready to trade smart? Understanding BTZO fees helps you keep more of your profits and trade with confidence!

Frequently Asked Questions

Use limit orders instead of market orders. Limit orders usually get maker fees, which are lower than taker fees. It’s an easy way to save from day one.

Immediately! Once you reach the required trading volume, your new VIP level and lower fees start right away. No waiting or paperwork.

No hidden trading fees. BTZO shows all costs clearly. Other services like withdrawals have separate network fees, but these are always shown before you confirm.